Rollover Requirement

Waiver of 60 Day Rollover Requirement

Under IRC section 402(c), a taxpayer can avoid being subject to federal income tax on receipt of funds distributed from a qualified retirement plan or IRA if the taxpayer rolls over such funds into another qualified retirement plan or IRA within 60 days. Generally this 60 day rollover rule is applied strictly. But this can lead to some harsh results.

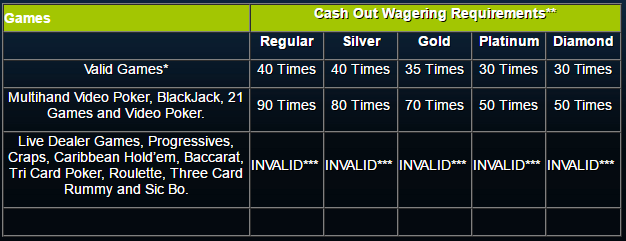

Rollover Requirements Rollover requirements are instilled by sportsbooks to ensure bettors can’t receive a bonus, make a few small wagers, and withdraw more money than they deposited with the bonus. Rollover requirements for sports betting often range between 1X-10X, with some extreme requirements going all the way up to 15X. Rollover requirements are typically expressed with multipliers like 3X, 5X, or 8X. These numbers mean the rollover that you have to meet will vary by player, and more specifically, by how much you initially deposited. Perhaps a simple calculation will best help explain how rollovers work.

The Tax Court recently held that IRS denials of waivers of the 60-day rollover requirement are subject to judicial review. The court concluded it may reverse an IRS denial of a waiver if it finds the Service abused its discretion, i.e., acted 'arbitrarily, capriciously, or without sound basis in law or fact.' A sportsbook rollover requirement refers to the wagering that a bettor must undertake before he is allowed to withdraw a bonus that he has received. For example, consider a bettor who deposited $300 at a sportsbook site offering a 30% signup bonus, thereby ending up with a beginning bankroll of $390. The rollover requirement is a set amount of action, based on your deposit plus bonus, that must be achieved before withdrawal. Without the requirement, players could deposit, receive the bonus and immediately withdraw. If this were the case we could not offer the world class bonuses which we do.

In a series of Private Letter Rulings (“PLRs”) the IRS agreed to waive the 60 day rule in certain situation. While PLRs are not binding precedent, they do indicate what the IRS is likely to do in certain situations.

In PLR 201625021, the IRS waived the 60 day rollover requirement where the taxpayer’s failure to timely roll over the funds was due to an error by the financial institution. In a similar case, PLR 201625026, the IRS waived the 60 day rollover requirement where the taxpayer’s failure to timely roll over funds was due to failure of a company representative to follow the taxpayer’s instructions.

In PLR 201625023, the IRS waived 60-day rollover requirement where the taxpayer’s failure to timely roll over funds was due to her misunderstanding based on the company’s confusing financial statements.

In PLR 201625024, the IRS waived 60-day rollover requirement where the taxpayer’s failure to timely roll over funds was due to his ongoing medical condition that impaired his ability to manage his financial affairs. Likewise in PLR 201625025, the IRS waived the 60-day rollover requirement where the taxpayer’s failure to timely roll over funds was due to her hospitalization and treatments.

Getting a waiver of the 60 day requirement requires paying a user fee and submitting a private letter ruling request to the IRS. We can assist with this process.

Mybookie Rollover Requirements

If you have received a distribution from a qualified retirement plan or IRA and inadvertently failed to timely roll over the funds into another qualified retirement plan or IRA, please give us a call or email at 937-223-1130 or Jsenney@pselaw.com and we can discuss obtaining a possible waiver of the 60 day requirement.

A rollover requirement is the total amount that a customer must bet in order to have the funds made available to withdraw, or withdrawn without extra fees.

60 Day Ira Rollover Period

A 1x rollover requirement means that you must bet the amount you deposited once. This is the minimum rollover required in order to withdraw funds, due to AML (Anti-Money Laundering) requirements for the industry.

Rollover Requirement Betting

A 3x rollover requirement means you must bet the amount you deposited three times. At Pinnacle, we require a 3x rollover in order to withdraw funds without incurring extra fees. You may opt for the 1x minimum rollover, although this will incur extra withdrawal fees.

1 Rollover Per Year Rule

Please note that this is an industry standard across sportsbooks.